Credit mistakes first-time homebuyers make

Whether you are buying your first, second, or third home, buying that first home is an exciting and nerve-racking experience. Above all, you need to locate an inexpensive home. Low inventory in many local markets and rising home values across the nation can make it challenging to find an affordable home.

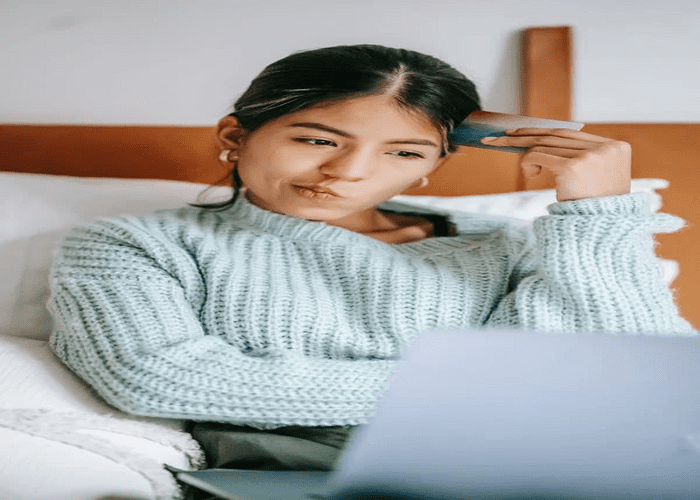

Before visiting the houses of interest, you might want to think carefully about your financial situation, including your credit history and credit score, your ratio of debt to income, and your general economic picture.

Many first-time buyers make many basic errors in the house-buying and mortgage processes. One of the most typical mistakes to avoid is applying for an incorrect loan.

“I Didn’t Know My Credit Score Until it was Too Late.”

Nobody likes open secrets, especially before closing on a home. Suppose you or your spouse have problems with obvious credit issues like previous late payments, debt collection actions, or significant debt. In that case, lenders can provide insensitive rates and terms (or deny your application outright). This can be aggravating and delay reaching your overall objective.

Mortgage shoppers could be missing out

Buyers who fail to shop around for a mortgage leave thousands on the table. Taking out a mortgage with several different lenders lets you get a clear picture of what you can afford and makes it possible to compare them on an equal basis in terms of loan products, interest rates, fees, and closing costs. More important, shopping for a mortgage lets you in a better position to negotiate with lenders and be more fashionably assertive during the process.

“Is it worth it to spend more on a home than you can afford?”

You might not want to pick an expensive home just because it’s more likely to gratify your monthly budget. In other words, you might wind up being house poor, and you may experience buyer remorse.

Disaster insurance, home repairs, property taxes, homeowner’s association fees (if applicable), and the identical nonpayment will not be a burden when you possess your own home. You will need to save up for unforeseen repairs, home mortgage insurance, property taxes, and other costs you don’t need to jot down as a lessee.

Rather than the highest possible loan amount for which you qualified, focus on whether you can afford to make the monthly mortgage payments at that price point. First-time home buyers should bear in mind that it’s important not to agree to the most inexpensive home based on their budget and configure their finances in such a way as to prepare the most feasible budget.

Don’t Overdo It: How Multiple Opening Lines of Credit Can Backfire

Some creditors may close your account for lengthy inactivity, which isn’t good for your credit rating. To keep your account engaged in lowering adverse reports to your credit, managing small purchases that you pay off entirely and promptly regularly.

The Bottom Line: An Expert Opinion

Don’t let financial mistakes become obstacles to your home purchase and mortgage. Although some of these infractions appear insignificant, they can cause problems in closing and cost you tons of time.

Speak to your lender about what you should do at every step, from pre-approval to closing, to complete a process as smoothly as possible. Make sure to update your files, bank records, W-2s, deposit reports, tax returns, and pay stubs so that you’ll have everything you need if your lender requires it.

If the time comes for your first real estate purchase, being knowledgeable and focused on the lending and real estate process might help you avoid some of these mistakes and reduce the amount of heat loss in the process. Keep things going through the transaction by hiring trained professionals to support you. That way, you won’t encounter any unnecessary surprises.