“You’re never too young to start building credit.”

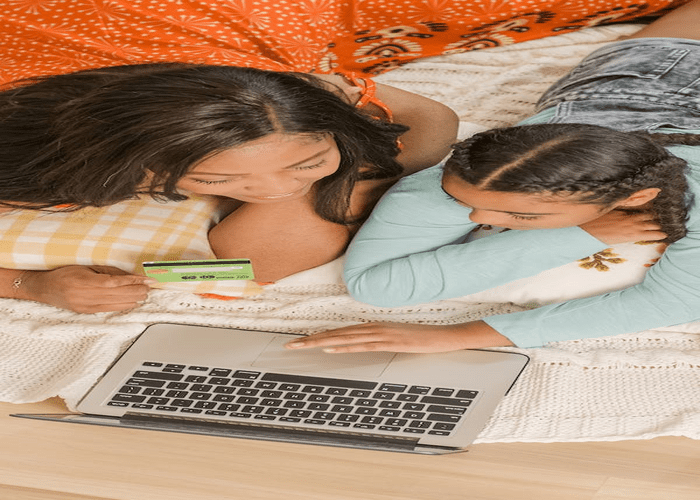

Establishing a positive credit report for your child will give them independence and confidence as they grow older and make the most of the opportunities at their disposal. The good news is your child doesn’t have to be 18 to start building their credit score. Using credit from home can help your kid get started on the path to credit, setting them up for a host of opportunities in the future.

Do you know your child’s credit score?

For the most part, only those over 18 have a credit rating, but it is possible that minors can develop a credit rating. A child can have a credit report if their goods are deposited and used to open a line of credit. A credit agency accidentally made a credit report in the minor’s name. When a parent or guardian put their credit card info to use the minor as an authorized user or opened a joint account, the reporting agency submitted a minor’s credit report in error.

Wondering when you can start helping your child build credit? Here’s what you need

If you intend on building your credit before your adolescent turns 18, you can sign up as an authorized user of any or all of your credit cards. There is no legal minimum age for adding your child as an authorized user. However, you should check your credit card issuer’s policy. Chase, as an example, does not report legal persons under the age of 18 to the timing reporting companies.

Those with 18 as the minimum age for credit-builder loans and credit cards can carry them out independently, although exceptions generally apply. Young people must make an application and get approval by age 21. Other financial products, such as credit-builder loans, have similar minimum age limits.

A parent’s guide to adding their child to their credit card

Adding a minor as a permitted user can help the minor’s credit rating. In some instances, credit card issuers report to the credit bureaus the payment histories of every cardholder who holds a cosigner and authorized user. So adding your child as a permitted user will help your child build credit the minor piggybacks on from the cosigner’s good credit behavior.

Not all credit card issuers report authorized user charge history to the credit bureaus but check with your card company regarding its policies.

Paying outstanding balances and other credit card expenses on time improves users’ credit, while bad bookkeeping that misses payments can negatively influence it. Do not add an authorized user unless you can ensure your payments will always be on time and have enough money to repay the loan.

Building credit for your children- what are the alternatives?

There are several reward programs for helping adolescents enhance their credit scores. Note that all of the rewards programs detailed below have a minimum age of 18.

How to take out a personal loan without ruining your finances?

Personal loans with higher interest rates are often taken out in an emergency. Still, if a personal loan is used responsibly, it can be beneficial in setting up an individual’s credit score. Taking out a minor financial loan could help young people improve their credit history soundly. A small personal loan in a well-controlled manner could help an individual improve their credit rating.

Is a credit-builder loan right for you?

Secured credit-builder loans are designed to help individuals who aren’t old enough or haven’t built credit fully yet establish credit history through timely payments and solid fiscal behavior. Unfortunately, secured credit-builder loans often have very high fees and interest rates that won’t fit much into your budget. When factoring in the administrative expenses and the cost of repayments, make sure you break down the costs to determine how they will fit into your current budget.

Build your credit with a secured credit card!

Secured credit cards, such as credit-builder loans, help people lift their credit simply by opening an account. When you open a card, you make a small deposit that serves as a guarantee and effectively becomes your credit limit. Before you sign up for a secured credit card, research the types of fees, annual fees, and interest rates that may apply.

How do you check your child’s credit report?

Checking your little one’s credit report can vary, based on your kid’s age, but it’s recommended to at least try to do so when they’re old enough to check their credit report legally. The Federal Trade Commission recommends that parents order their kid’s credit reports when they turn 16.

If your child is over the age of 13

Individuals aged 13 or older may access a free credit history through the AnnualCreditReport.com website. Federal laws permit individuals to request one free annual credit report from three different information repositories (Equifax, Experian, and TransUnion ).

If your child is under the age of 13

For kids younger than 18, a parent or legal guardian must register with the credit-reporting agencies by mail and furnish particular identifying information to see if a credit report can be found in the underage child’s name. Each credit agency has its requirements, so speak to them about the information you’ll need to provide to verify whether your underage child has a credit account.

Get a head start on your child’s financial future by helping them

Establishing your child’s credit rating will assist them in building a better financial future. Add your child to one or more of your credit card accounts or lease if they are mature enough, or consider jointly opening a family credit card or loan. The key is for your child to develop good borrowing habits as they build their credit rating, so make sure to emphasize the importance of sticking to your payment schedule.